Fixed Price vs. Time and Materials: An Analytical Guide for Data Leaders

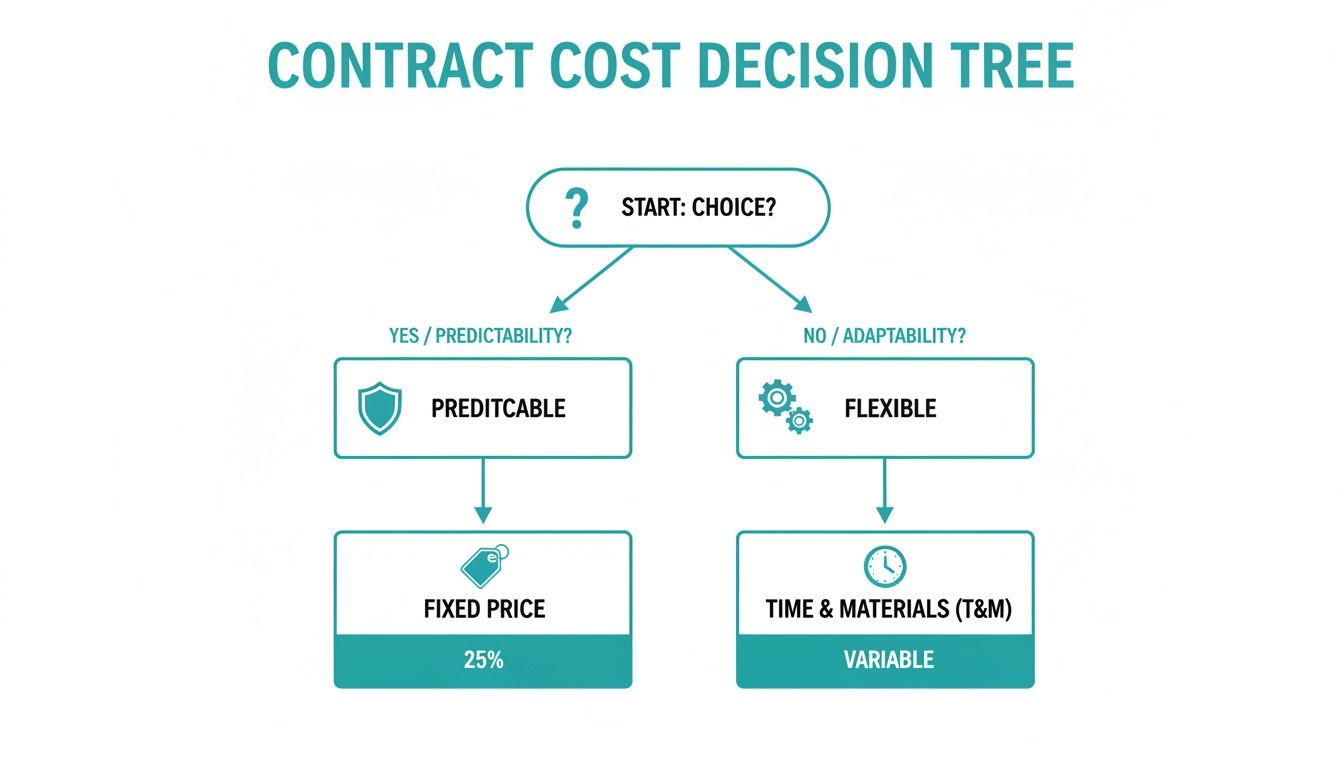

The choice between a Fixed Price and a Time and Materials contract hinges on a single trade-off: budget certainty vs. project flexibility. For a well-defined, static scope, a Fixed Price agreement offers predictability. For complex data engineering—where requirements inevitably evolve—the adaptability of a Time and Materials (T&M) model consistently yields superior outcomes.

The Strategic Choice Between Fixed Price and T&M Models

Selecting a contract model for a data engineering project is a strategic decision that dictates the operational reality of the engagement. It defines risk allocation, agility, and ultimately, the business value generated. In a field defined by rapid technological shifts, a rigid contractual structure is a significant liability.

This guide provides an analytical framework for data leaders facing the practical dilemma of how to control budgets while enabling teams to adapt and innovate on high-stakes data initiatives in 2025 and beyond.

Why This Decision Matters More Than Ever

Modern data projects are inherently complex. Whether migrating to Snowflake or developing a new AI/ML pipeline, comprehensive upfront planning is rarely feasible. Technical debt, new data source integrations, and shifting business requirements are standard occurrences. The contract model determines the mechanism for addressing these realities.

The data is clear. A Norwegian study analyzing 35 public software projects revealed a significant performance gap: 83% of Time and Materials projects were successful, compared to only 38% of fixed-price projects. The analysis also found that forcing exhaustive upfront planning for fixed-price contracts delayed project kickoffs by an average of 20-30% while producing inferior results. You can find a deep dive into these project model findings for more context.

The operative question is not “Which model is cheaper?” but “Which model creates the optimal incentives and flexibility to achieve our objectives?” The answer depends on which party bears the risk of uncertainty—the client or the vendor.

Here is a summary of the fundamental differences before a detailed analysis.

| Feature | Fixed Price Model | Time & Materials (T&M) Model |

|---|---|---|

| Primary Benefit | Budget predictability and low financial risk | High flexibility and adaptability |

| Best For | Well-defined, stable, short-term projects | Complex, long-term, or evolving projects |

| Scope Management | Rigid; changes require formal change orders | Agile; scope can be adjusted iteratively |

| Client Involvement | Low day-to-day engagement required | High collaboration and regular feedback |

Comparing the Core Mechanics of Each Project Model

To evaluate the Fixed Price vs. Time and Materials models, one must analyze their operational mechanics. These mechanics influence risk allocation, budget management, scope control, quality incentives, and administrative overhead. This analysis focuses on the practical implications of each model during project execution.

Risk Allocation: Where Does the Burden Lie?

The primary distinction is risk allocation. In a Fixed Price contract, the vendor assumes nearly all financial risk. They are obligated to deliver a specified scope for a set price. Unforeseen technical debt or underestimated task complexity directly impacts their profit margin, not the client’s budget.

Conversely, a Time and Materials (T&M) model places most of the risk on the client. The client pays for the actual time and resources consumed. If initial requirements are ambiguous or a data source integration proves more complex than anticipated, the final cost will reflect the additional effort.

Fixed Price provides a perception of safety but can incentivize the vendor to defend the scope rigidly, potentially rejecting beneficial adjustments. T&M necessitates greater client oversight but fosters a partnership focused on collaborative problem-solving.

Budget Control: Predictability Versus Flexibility

The models present different approaches to financial management. A Fixed Price agreement offers upfront budget predictability. The total cost is known from the outset, simplifying financial planning and stakeholder reporting. Barring scope changes, there are no financial surprises.

T&M provides real-time budget flexibility. The client is not locked into a single figure and can scale resources up or down based on shifting priorities. This model offers superior transparency, as detailed reporting shows precisely where every hour and dollar is allocated.

The trade-off is straightforward: Fixed Price offers a predictable total, while T&M provides transparent control over a variable total. The choice depends on whether the organization prioritizes a fixed forecast over the ability to adapt spending to project realities.

Scope Management: Rigid SOWs Versus Agile Backlogs

The mechanism for managing scope is a key differentiator. A Fixed Price project is governed by its Statement of Work (SOW), which exhaustively details every feature and deliverable. Any deviation requires a formal change control process, which introduces delays and additional costs.

A T&M project typically operates with an agile backlog, a dynamic, prioritized list of tasks. This structure is designed for iterative refinement. If mid-project feedback suggests a better approach for a data platform modernization, the team can pivot in the next sprint without formal contract renegotiation. This is essential for data projects where discovery is an inherent part of the process.

Quality Incentives: Speed Versus Thoroughness

The underlying incentives for the project team differ significantly. In a Fixed Price model, the vendor’s primary incentive is to complete the work as efficiently as possible to protect their profit margin. This can create a risk of corner-cutting or prioritizing the quickest solution over the most robust and scalable one.

Under a T&M model, the incentive shifts toward delivering the best possible solution. Because the team is compensated for their time, they can focus on quality, conduct proper testing, and address technical debt without negatively impacting their financials. The model aligns vendor and client interests toward a high-quality outcome, as client satisfaction is key to the engagement’s continuation.

Administrative Overhead: Front-Loaded Versus Continuous

The administrative workload profile is also distinct. Fixed Price contracts demand a significant front-loaded planning effort, often requiring weeks or months to define requirements in detail before development begins.

T&M projects have a lighter upfront planning phase but require continuous administrative engagement from the client. This includes reviewing weekly progress, tracking budget burn rates, and actively participating in sprint planning. The workload is distributed throughout the project’s lifecycle, necessitating consistent involvement.

The following table provides a side-by-side comparison of how each model functions across key project dimensions.

Core Mechanics Breakdown: Fixed Price vs. Time and Materials

| Project Dimension | Fixed Price Model | Time and Materials (T&M) Model |

|---|---|---|

| Risk | Vendor absorbs cost overruns; high risk for the delivery team if scope is underestimated. | Client absorbs cost overruns; high risk for the client if scope is unclear or expands. |

| Budget | Predictable and fixed. Set at the start, making financial planning simple. | Flexible and variable. Based on actual effort, offering transparency but less predictability. |

| Scope | Rigid. Defined in a detailed SOW; changes require a formal, often costly, process. | Flexible. Managed via an agile backlog; can be adapted sprint-by-sprint. |

| Quality Focus | Incentive is on efficiency and speed to protect profit margins. Can risk technical debt. | Incentive is on thoroughness and quality to ensure client satisfaction and continued work. |

| Client Role | Heavily involved upfront in defining scope, then steps back for oversight. | Continuously involved in prioritization, feedback, and budget management. |

| Best For | Well-defined, stable projects with zero ambiguity (e.g., a lift-and-shift migration). | Complex, evolving projects where requirements are likely to change (e.g., AI/ML pipelines). |

There is no universally superior option. The optimal choice depends on the project’s specific characteristics, the organization’s risk tolerance, and the degree of flexibility required to achieve a successful outcome.

Analyzing True Costs and Hidden Financial Premiums

A direct comparison of a fixed-price bid against a time and materials proposal is often misleading. The true, total cost of a data engineering project is influenced by hidden premiums, risk buffers, and the inherent efficiency of the contract model.

A fixed-price contract often appears to be the safer financial option, but it includes a significant, non-transparent cost: the risk premium. Vendors do not absorb project risk for free; they build a substantial buffer into their quotes to protect their margins from scope creep, ambiguous requirements, or estimation errors.

The Hidden Cost of the Fixed Price Risk Premium

The risk premium is a silent cost inflator in fixed-price contracts. To hedge against uncertainty, vendors typically add a 20-30% cushion to their internal cost estimate. A project estimated to require $200,000 in actual effort is therefore quoted at $240,000 to $260,000.

The client is effectively pre-paying for contingencies that may never occur. If the project proceeds smoothly and the vendor’s team operates more efficiently than planned, this premium becomes pure vendor profit. No portion of it is returned to the client.

A fixed-price contract does not eliminate the cost of uncertainty; it transfers the risk to the vendor, and the client pays a premium for that transfer. The critical question is whether this insurance is worth the price.

This dynamic is particularly costly in data projects. For example, a $100,000 fixed-price data pipeline project quote likely includes a $20,000-$30,000 buffer to cover unknowns, such as changing analytics requirements or a pivot during a Snowflake vs. Databricks evaluation. A more flexible T&M model avoids these embedded buffers, potentially reducing total project costs by 15-20% over the long term. You can read more about how vendors price fixed-price projects on elitecoders.co.

Unpacking the Financial Transparency of T&M

The Time & Materials model is defined by its financial transparency. The cost structure is simple: the client pays an agreed-upon rate for the actual time consultants spend on the project, plus the cost of any materials. There is no hidden risk premium.

This model directly links cost to effort. If a task is completed faster than estimated, the client realizes the savings immediately. The invoice reflects the actual work performed, providing a clear, auditable trail of budget expenditure. To better estimate potential project costs, you can use our comprehensive data engineering cost calculator.

This transparency, however, places the responsibility of budget oversight on the client. Without disciplined governance, the flexibility of T&M can lead to budget overruns. Success depends on a strong client-vendor partnership and robust project management.

- Weekly Burn Reports: The vendor must provide detailed reports showing hours logged, progress against milestones, and remaining budget. This is a non-negotiable requirement.

- Active Prioritization: The client’s team must participate in sprint planning to ensure engineering efforts are consistently aligned with high-value business objectives.

- Budget Caps: Financial guardrails can be implemented without sacrificing flexibility. Use not-to-exceed clauses or set budget caps for specific project phases.

Ultimately, the “true cost” encompasses more than the final invoice. It includes the business value of the delivered solution, the agility to respond to new information, and the overall process efficiency. A T&M project that costs 10% more but delivers a solution perfectly aligned with current market needs is a better investment than a fixed-price project that delivers an outdated solution on budget.

When to Choose Each Model for Data Engineering Projects

The decision between a fixed price and a time and materials contract is a strategic one, contingent on the specific nature of the data engineering work. The correct model establishes the framework for collaboration, risk management, and success. The choice depends on project clarity, technical uncertainty, and the required level of adaptability.

This decision tree illustrates the core trade-off: budget certainty versus project agility.

While a fixed price provides a sense of security, this often comes with a built-in risk premium. A T&M model ties cost directly to actual effort, making it better suited for projects with inherent uncertainty.

Cloud Data Platform Modernization

Modernizing a data platform is a process of discovery. While the initial goal—migrating from on-premise servers to a modern cloud stack—may be clear, unforeseen challenges are guaranteed. Hidden data dependencies, technical debt, and new optimization opportunities invariably surface during implementation.

For this type of initiative, a Time & Materials (T&M) model is the most appropriate choice. It provides the necessary flexibility for the team to adapt as they uncover new information. T&M aligns with an agile, sprint-based methodology, allowing for iterative scope refinement. This ensures the final platform serves the business’s actual needs, rather than being a simple replication of the legacy system.

Attempting to constrain a complex, multi-year modernization within a fixed-price contract is ill-advised. It would require defining every detail upfront—an impossible task that stifles the very innovation the project aims to achieve.

Snowflake or Databricks Migration

Migration to a platform like Snowflake or Databricks typically occurs in two phases. The first is often a “lift-and-shift” of existing, well-documented data warehouses and ETL processes. This phase is highly predictable.

The second phase involves optimization and expansion: refactoring business logic, re-engineering queries for the new platform, and building new data models to leverage advanced features. This work is inherently unpredictable.

A hybrid approach is optimal here.

- Phase 1 (Lift-and-Shift): Use a Fixed Price model for migrating known, clearly defined assets. The tasks are repetitive and the scope is stable.

- Phase 2 (Optimization & Expansion): Shift to a T&M model for the value-add work. This gives the team the freedom to explore the new platform’s capabilities without the constraints of a rigid SOW.

AI and ML Data Pipeline Development

Developing data pipelines for AI and Machine Learning is fundamentally an experimental process. It involves a cycle of hypothesis, feature engineering, and iterative model training. Data requirements can change rapidly based on model performance, and the path to a production-ready pipeline is rarely linear.

For these projects, T&M is the only viable option. The flexibility of a T&M contract mirrors the scientific method inherent in AI/ML development. It allows data scientists and engineers to collaborate, test hypotheses, and pivot quickly without the administrative burden of contract renegotiations.

Forcing an AI/ML project into a fixed-price contract is a setup for failure. It incentivizes the vendor to deliver on the initial, often flawed, scope rather than pursuing the optimal model. This demonstrates a misunderstanding of how exploratory work is conducted.

Research confirms the link between rigid contracts and project failure in AI-driven development. T&M models achieve success rates as high as 83% in these environments, while fixed-price models struggle at just 38%. As detailed in a 2025 analysis by BayTech Consulting, fixed-price contracts can create counterproductive behaviors that undermine innovative projects.

Exploring Hybrid and Guardrail Models

Beyond the standard models, several hybrid approaches offer a balance of cost control and agility. These are effective when some budget predictability is required, but flexibility cannot be sacrificed.

- Capped T&M: A standard T&M contract with a “not-to-exceed” clause. This provides the operational flexibility of T&M with a hard ceiling on total spend, protecting against cost overruns.

- Fixed Price Per Sprint: The project is divided into agile sprints, with each sprint treated as a mini-fixed-price engagement. This offers predictable costs in short intervals while allowing for backlog reprioritization before each new sprint.

- T&M with Performance Incentives: A portion of the vendor’s fee is tied to specific milestones or performance metrics. This aligns incentives toward a successful outcome while maintaining day-to-day operational flexibility.

Mastering Governance and Contracting Best Practices

Selecting the appropriate pricing model is only the first step. Effective execution depends on robust governance and a well-constructed contract. The Statement of Work (SOW) or Master Service Agreement (MSA) serves as the operational framework for the engagement, translating agreement into an actionable plan.

Without a solid contractual foundation, projects can become mired in disputes, budget overruns, and damaged vendor relationships. The following sections detail how to structure contracts and governance routines for both Fixed Price and Time and Materials models.

Crafting Airtight Fixed Price Contracts

A Fixed Price contract provides certainty. To ensure that certainty is realized, the contract must be meticulously specific. Ambiguity is the primary source of costly change orders.

The SOW must be highly detailed, focusing on three key areas:

- Ironclad Acceptance Criteria: Vague descriptions like “a user-friendly dashboard” are insufficient. Success must be defined with measurable, testable criteria. For example: “The sales performance dashboard must load in under 3 seconds with 50 concurrent users, with data latency from the source system not exceeding 15 minutes.”

- A Rigid Change Control Process: Scope creep is a significant budget risk. The contract must outline the precise process for proposing, evaluating, and approving any changes, including approval authority and expected turnaround times. This formalizes the process and prevents informal scope expansion.

- Milestone-Based Payment Schedules: Payments should be tied directly to the successful delivery and formal acceptance of specific milestones. This incentivizes the vendor to meet deadlines and provides the client with leverage if progress stalls.

The value of a Fixed Price contract lies in its precision. If a deliverable cannot be defined with objective, testable criteria, it is not suitable for a fixed-scope agreement.

Key Clauses for Time and Materials Agreements

With a Time and Materials (T&M) model, the contractual focus shifts from defining the what to controlling the how. The contract’s purpose is to enforce transparency and accountability to ensure flexibility does not lead to uncontrolled spending.

The agreement must include these essential guardrails:

- Detailed Rate Cards: Lock in specific hourly or daily rates by role (e.g., Principal Data Architect, Senior Data Engineer, QA Analyst) for the contract’s duration.

- Resource Approval Workflow: The contract must stipulate that no personnel can be added to the project or bill time without explicit, written client approval.

- Transparent Time Tracking: Mandate detailed weekly timesheets that break down time spent against specific tasks, features, or user stories, providing a clear audit trail of expenditures.

- Budget Caps or Not-to-Exceed Limits: Implement a “Capped T&M” model by setting a hard ceiling on the total spend. This combines the flexibility of T&M with a predictable budget cap.

Establishing a Robust Governance Framework

The contract defines the rules; the governance framework dictates day-to-day execution. A consistent cadence of meetings and reports is essential for keeping both Fixed Price and T&M projects on track. For a detailed guide on building a vendor evaluation process, our data engineering RFP checklist offers over 50 critical criteria.

An effective governance plan should mandate a reporting cadence like the one below:

| Reporting Cadence | Fixed Price Focus | Time and Materials Focus |

|---|---|---|

| Weekly | RAG Status on Milestones | Budget Burn vs. Actuals Report |

| Bi-Weekly | Demos of In-Progress Deliverables | Review of Sprint Burn-Down Charts |

| Monthly | Review of Change Request Log | Resource Utilization & Team Efficiency Report |

This structured communication ensures alignment and provides an early warning system for potential issues. The success of any project, regardless of pricing model, depends on the strength of the contract and the discipline of its governance.

How to Select the Right Data Engineering Partner

Selecting a data engineering partner requires evaluating their operational philosophy, not just their technical skills. A vendor’s approach to contracting—whether Fixed Price or Time & Materials—reveals their perspective on risk, change management, and collaboration.

Asking targeted questions during the procurement process can prevent significant future problems. You are procuring a partnership, not just a block of developer hours. This process helps determine if a firm is a good cultural and operational fit. For a comprehensive overview of the evaluation process, see our guide on how to choose a data engineering company.

Critical Questions for Your RFP

Your RFP should probe how a vendor works, not just what they can do. Structure questions to reveal their real-world processes.

- For Fixed Price Bids: “Describe your change control process in detail. What are the specific steps when a critical new business requirement is identified mid-project?” A vague response is a major red flag.

- For T&M Proposals: “What specific tools and reports will we receive, and at what frequency, to track budget burn and progress?” Look for concrete answers like weekly burn-down charts or direct access to their project management system, not just promises of “transparency.”

- For Agile Projects: “Describe a time a data pipeline project encountered unexpected technical debt. How was this communicated to the client, and how was the plan adapted under a T&M model?”

A vendor’s process for managing unforeseen events is a far better indicator of success than their initial quote. A low fixed-price bid from an inflexible vendor often results in higher total costs due to delays and rework than a T&M engagement with a communicative, adaptable team.

Red Flags to Watch For

Evaluate a vendor’s actions during the sales process as an indicator of their future performance.

- Pushing Fixed Price for R&D: A firm insisting on a rigid fixed-price contract for an experimental AI/ML pipeline either misunderstands the nature of the work or is building in an excessive risk premium.

- Ambiguous Reporting Practices: Budget updates should be proactive and regular. If a T&M proposal is unclear about the specifics of time tracking and progress reporting, it indicates weak project governance.

- No Access to Senior Talent: If you cannot engage with a senior architect or principal engineer to discuss technical challenges during the vetting process, you are not truly evaluating their expertise.

Common Questions from the Trenches

When it comes to the Fixed Price versus Time & Materials debate, theory is one thing, but practice is another. Data leaders often get stuck on a few key questions. Here are the straight answers you need to cut through the noise.

Can a Time and Materials Project Just Run Forever and Blow the Budget?

Yes, but only with lax governance. A T&M contract should not be treated as a blank check. The key is to implement contractual guardrails and maintain active client oversight.

The client is responsible for controlling the project’s trajectory. To prevent cost overruns, implement the following controls:

- Set a Hard Cap: Insist on a “not-to-exceed” clause in the contract to establish a firm budget ceiling.

- Demand Weekly Burn Reports: Require weekly updates showing hours logged against specific tasks and the remaining budget.

- Own the Priorities: Client teams must participate in sprint planning to ensure the vendor is consistently working on the highest-value tasks.

With these controls, you gain the flexibility of T&M without the risk of uncontrolled spending.

Is Fixed Price Always Cheaper if the Project is Well-Defined?

Not necessarily. A fixed-price quote almost always includes a hidden 20-30% risk premium. The vendor must build in a buffer to protect against unforeseen issues, even on seemingly straightforward projects.

If the project proceeds without issue, the client has overpaid by the full amount of the risk premium. This amount becomes pure vendor profit, with no benefit to the client.

For a well-defined scope, a transparent T&M model can be cheaper because you only pay for the actual work performed, not for the vendor’s contingency planning.

How Does a “Capped T&M” Hybrid Model Really Work?

A Capped T&M model offers a practical middle ground. It functions as a standard T&M agreement—you pay for hours worked at a pre-defined rate—but includes a firm budget ceiling that cannot be exceeded.

This structure provides the agility to adjust priorities as the project evolves, which is critical in data engineering. Simultaneously, it offers the financial predictability of a guaranteed maximum spend. It is an excellent fit for projects that require flexibility but operate under strict budget constraints.

Choosing the right pricing model is half the battle; finding the right data engineering partner is the other. At DataEngineeringCompanies.com, we vet and rank top consultancies to help you make a data-driven choice. Explore our 2025 expert rankings to make your next big decision with confidence.

Top Data Engineering Partners

Vetted experts who can help you implement what you just read.

Related Analysis

A Practical Guide to Streaming Data Platforms

A practical guide to understanding a streaming data platform. Learn core architectures, use cases, and how to choose the right tools for real-time results.

Database Migration Strategies: A Practical Guide to Seamless Transitions

Discover database migration strategies for a seamless, risk-aware transition. Learn proven frameworks, cost insights, and actionable steps.

Orchestration in Cloud: A Practical Guide for Modern Data Platforms

Discover how orchestration in cloud streamlines modern data platforms. Learn key concepts, tools, and best practices for scalable, reliable operations.